Armstrong meets prevailing wage and apprenticeship requirements PLUS the domestic content of materials used in production of TEMPLOK Energy Saving Ceilings.

Save more than just ener

with TEMPLOK Energy Saving Ceilngs and tax credits of up to 50%*.

Make your next project more affordable and save up to 15% energy** with TEMPLOK Energy Saving Ceilings.

Pay less for a ceiling that does more. A variety of federal and state income tax credits and deductions for energy-saving products may make TEMPLOK ceiling panels a more affordable option than standard mineral fiber counterparts.

In addition to reduced energy costs, TEMPLOK ceiling panels provide exceptional acoustical performance and increased thermal comfort, benefitting both building owners and occupants for years to come.

* This document lists various federal tax credits and deductions that your project may qualify for when purchasing Templok Energy Saving Ceilings. Please consult your own tax attorney or advisor.

**Measured cooling energy savings in lab test. Results may vary.

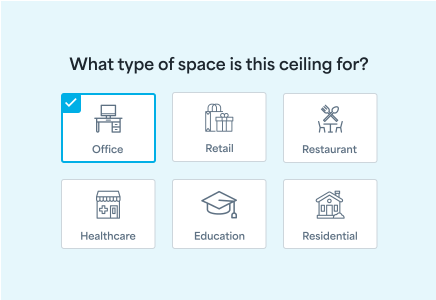

Is a TEMPLOK ceiling right for your space?

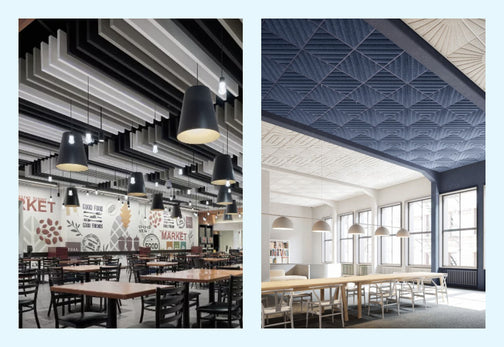

Take advantage of an often-overlooked area in the construction industry: the ceiling plane. TEMPLOK Energy Saving Ceilings utilize phase change material (PCM) to transform these large surface areas into more sustainable, resilient spaces. Add thermal energy storage sentence

Who Qualifies? 123

- Architects

- Engineers

- Design/Build Contractors

- Building Automation Companies

Ideal Projects

- K-12 Schools

- Military Bases

- Museums*

- Courthouses

- Universities

- Religious Buildings*

- Hospitals*

- Dormitories

- Non-profit*

- Convention Centers

- Private Universities*

- Sports Arenas

Tax incentive breakdown

Inflation Reduction Act of 2022, Section 48E

Under Section 48E, the purchase and use of Armstrong TEMPLOK Energy Saving Ceiling panels (containing thermal energy storage properties) may qualify for a federal investment tax credit of up to 50% of the product purchase cost.**

-

-

Get a 50%

Total credit amountIf TEMPLOK Energy Saving Ceilings are deployed in an “Energy Community” an additional 10% tax credit would be available.

Subcopy goes here. This is a text link

179D Energy Efficient Commercial Buildings Tax Deduction

Under Federal Internal Revenue Code 179D, commercial building owners may be able to claim a tax deduction. Refer to the Incentives FAQ for details. [We may need to add the paragraph of copy below if the FAQ is separate page, if FAQ, lives on this landing page, we can format this copy into FAQ format]

Commercial building owners who place in-service energy efficient commercial building property (EECBP) or energy efficient commercial building retrofit property (EEBRP*) may be able to claim a tax deduction equal to the lesser of (a) the cost of the installed property OR (b) $0.50 - $1.00 per square foot based on total percentage of energy savings. Templok Energy Saving Ceilings may qualify as part of a building’s heating, cooling or ventilation systems.

Eligibility for the deduction requires a certified plan for savings of at least 25% or more vs applicable (ASHRAE) standards.

- ASHRAE 90.1-2019 applies to buildings that began construction on or after January 1, 2023 and have energy efficient property placed in service on or after January 1, 2027.

- ASHRAE 90.1-2007 applies to buildings that began construction before January 1, 2023 or are placed in service before January 1, 2027.

* Buildings in the EEBRP process must be in operation for 5 years or more to qualify.

Ready to save on energy?

Contact us today to discuss your next Templok project and potential savings.

-

Call Us:

(866) 438 8833(Mon-Fri 8AM-8PM EST) -

Chat With Support

Thanks for subscribing!

Thanks for subscribing!